How to invest in a world of high inflation

A big headache for the charity sector

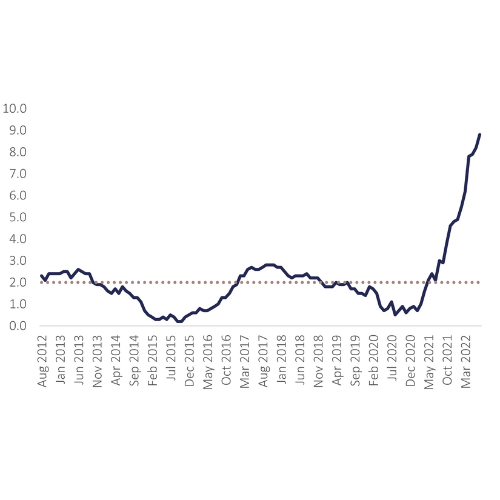

The transition from a low-inflation world to an era of high inflation has been rapid and dramatic. Until recently, inflation was very low in most Western countries and it was in fact deflation rather than inflation that was the cause for concern.

But as energy prices skyrocket and the cost of living balloons, the UK is now facing the prospect of inflation exceeding the Bank of England’s current forecast of 13.4% by the end of the year. This has big implications for charities, like many other areas of society.

Without significant government intervention, the human cost of the spike in inflation will be massive, particularly for lower-income households, for which energy makes up a sizeable proportion of their expenditure. And charities will be hit by a double whammy: with people’s disposable incomes down, gifting and fundraising are likely to be hit hard at a time that charities’ own running costs are rising rapidly. Many charities working with poorer groups will see a particularly sharp increase in demand for their services: the Resolution Foundation has estimated that around 14 million people in the UK could be in poverty by 2023-24, a rise of over 3 million from the previous year[1].

To put the financial problems facing charities into perspective, Pro Bono Economics calculates that an average charity with annual expenditure of £1m in 2020 would need to find an extra £113,000 by 2024 just to cover staffing costs to ensure their employees are not financially worse off than before.

Inflation to fall, but remain higher than where it’s been

Is high inflation here to stay, or will we get back to how things were in due course? Current forecasts suggest UK inflation will peak in Q1 next year before falling. Economic growth is already slowing down and this will reduce demand, which should in turn help to bring down inflation.

But there are also reasons to suggest that inflation could remain structurally higher than it has been over much of the past decade.

For example, factors such as deglobalisation, increased geopolitical tensions and Brexit have increased the costs of importing goods. The falling pound has also pushed up the cost of imports and the UK’s challenging economic outlook suggests that sterling could remain weak.

Charities with funds to invest are for the most part looking to preserve the value of their funds after inflation is factored in over the long term. So how can you take steps to protect against inflation in portfolios?

Where to invest

It’s some time since the developed world has been faced with an environment of high inflation, but we can learn lessons from how asset classes have behaved in previous periods of rising prices. Although, always bear in mind that past performance is not a reliable indicator of future performance.

Equities: be selective

Research into the US equity market shows that since World War 2, equities have tended to deliver positive real returns (returns in excess of inflation) in periods in which inflation has been above 5%, but when inflation has moved above 10% real returns have dropped dramatically.

Unsurprisingly there is a great disparity in the way different businesses cope with periods of higher inflation. Firms that have pricing power, enabling them to raise prices to offset higher labour and input costs, are best placed to cope with inflation. In such an environment we also typically favour companies with relatively high margins as they can provide a buffer against rising costs. Most of the companies that we invest in have comparatively low levels of debt on their balance sheet – typically half as much as the market average – which makes them more resilient when interest rates are rising to combat inflation. A strong balance sheet also provides companies with the flexibility to make opportunistic acquisitions to gain market share when some competitors are suffering.

Looking more closely at different sectors and industries, firms involved in the extraction, processing and distribution of commodities tend to perform relatively well in inflationary environments. Even in periods of very high inflation, miners and energy companies have generally provided returns in excess of inflation. However, environmental concerns mean that many of these firms are un-investable for charities that are concerned about sustainability.

By contrast, most consumer goods and retail-focused firms have tended to underperform. These companies are exposed to higher costs but are less able to pass them on to consumers without suffering from a drop in demand for their goods.

At the regional level, inflation is hitting the UK and the rest of Europe especially hard, in part due to the region’s reliance on imported energy. As the economic outlook in the near term looks challenging we’ve reduced our portfolios’ exposure to these markets relative to the US. But that’s not to say that no opportunities exist in the UK and Europe – for example, we’ve invested in a European discount retailer that we believe should prosper as consumers become more price-conscious. Many of our investments in this part of the world are in firms with a global presence and that aren’t reliant solely on domestic consumers.

Gold: a variety of benefits

Another asset that generally performs well in periods of inflation is gold. In fact, it’s also proved highly useful in periods of stagflation, which are marked by low growth and rising unemployment in addition to high inflation. Stagflation hasn’t been seen since the 1970s, but many economists believe it may be about to rear its ugly head.

Gold can also be used as a portfolio diversifier. That’s because its returns generally don’t move in line with those of equities or bonds. It also tends to do well in periods of severe market stress, when investors flock to safe-haven assets.

Infrastructure and renewable energy: indexed to inflation

Infrastructure assets include social infrastructure, which involves the building and operation of public assets like schools and hospitals, and economic infrastructure, which encompasses assets such as roads, bridges and railways. Investing in this sector can help protect an investment portfolio against inflation.

The reason is these ‘real’ assets benefit from long-term, government-backed contracts whose payments are indexed to inflation. That means if inflation goes up, so too does their income.

In the UK a number of government schemes have been established to encourage the construction of renewable energy assets. While many of the subsidy regimes have now closed, there are existing wind and solar schemes that provide attractive inflation-linked payments for the energy they generate.

Bonds: approach with caution

Many charities have avoided investing in bonds over the past few years as they have offered extremely low income yields and in some cases the prospect of a negative return. More recently, rising interest rates have pushed the prices of bonds down, with the result that bond yields have risen. Most bonds pay a fixed coupon payment and rising inflation and interest rates result in their prices falling. So far this year the UK gilt market has fallen much further than the FTSE All Share equity index.

Index-linked bonds pay investors a coupon that is linked to the rate of inflation. While this might sound attractive, they do involve some drawbacks. For a start, the market for these bonds is relatively small and dominated by insurance companies and pension providers who rely on these assets to hedge out inflation risk. This could put upwards pressure on prices, making them expensive. Furthermore, the market is already assuming inflation will remain elevated for some time, so inflation would have to rise by even more for these bonds to provide an attractive return relative to conventional bonds.

Don’t panic

The period between now and early 2023 could be very painful from an inflation perspective, particularly if the supply of Russian gas to Europe remains limited, as is likely. Markets are likely to remain volatile as investors try to second guess the scale of interest rate rises from Bank of England, their impact on inflation and on an already slowing economy. The scale of government support will also make a major difference.

However there are some reasons to be more constructive on the outlook for inflation. Supply constraints that were a result of pandemic related lockdowns appear to be easing. Freight indicators are improving and evidence from companies suggest that inventories and stock levels have been re-built. The Bank of England’s August report highlighted clear signs that the economy was slowing and this reduction in demand should ease inflationary pressures in the coming months.

We would always advocate building a diversified portfolio that can deal with a range of possible outcomes, not least as the path forwards from here does appear more uncertain than we’ve been used to for some time. As we’ve discussed in this article there are steps that can be taken to provide some degree of protection from inflation and for the moment we will continue to build these into portfolios. Markets though are capricious and it remains to be seen if current fears over inflation are overtaken by greater fears over slowing growth. Perhaps not the cheeriest note to end on.

[1] https://www.resolutionfoundation.org/app/uploads/2022/08/In-at-the-deep-end.pdf?bcs-agent-scanner=14b54bf4-67f8-714f-a991-f2b00b0bbfb5